You start your first job, and you finally have your own money to spend: a trip to the Caribbean, a morning Starbucks latte with steamed milk and a layer of foam, a new car. But when it comes to saving and investing, there are some simple mistakes that new graduates make -- and it could end up costing them hundreds of thousands of dollars down the road. Michael Liebman ’18, co-founder and president of financial literacy platform LearnLux, says that one of the biggest financial hurdles for millennials (and any generation) is a lack of education. “We see users who don’t know what they have access to; and if they do, they don’t know how to use the products effectively. The information is overwhelming and confusing, so people avoid making those kinds of decisions.”

Michael Liebman ’18, co-founder and president of financial literacy platform LearnLux, says that one of the biggest financial hurdles for millennials (and any generation) is a lack of education. “We see users who don’t know what they have access to; and if they do, they don’t know how to use the products effectively. The information is overwhelming and confusing, so people avoid making those kinds of decisions.”

Read more about LearnLux, and how it’s helping millennials with personal finance.

And knowledge is power. For 20-somethings, investing $20 per week could equal hundreds of thousands of dollars when it comes time to retire. But you don’t have to necessarily give up your lifestyle, just think about how you spend and how you save, says Liebman.

Avoid these 6 personal #finance pitfalls now and reap the rewards later #preparedu

TWEET THIS

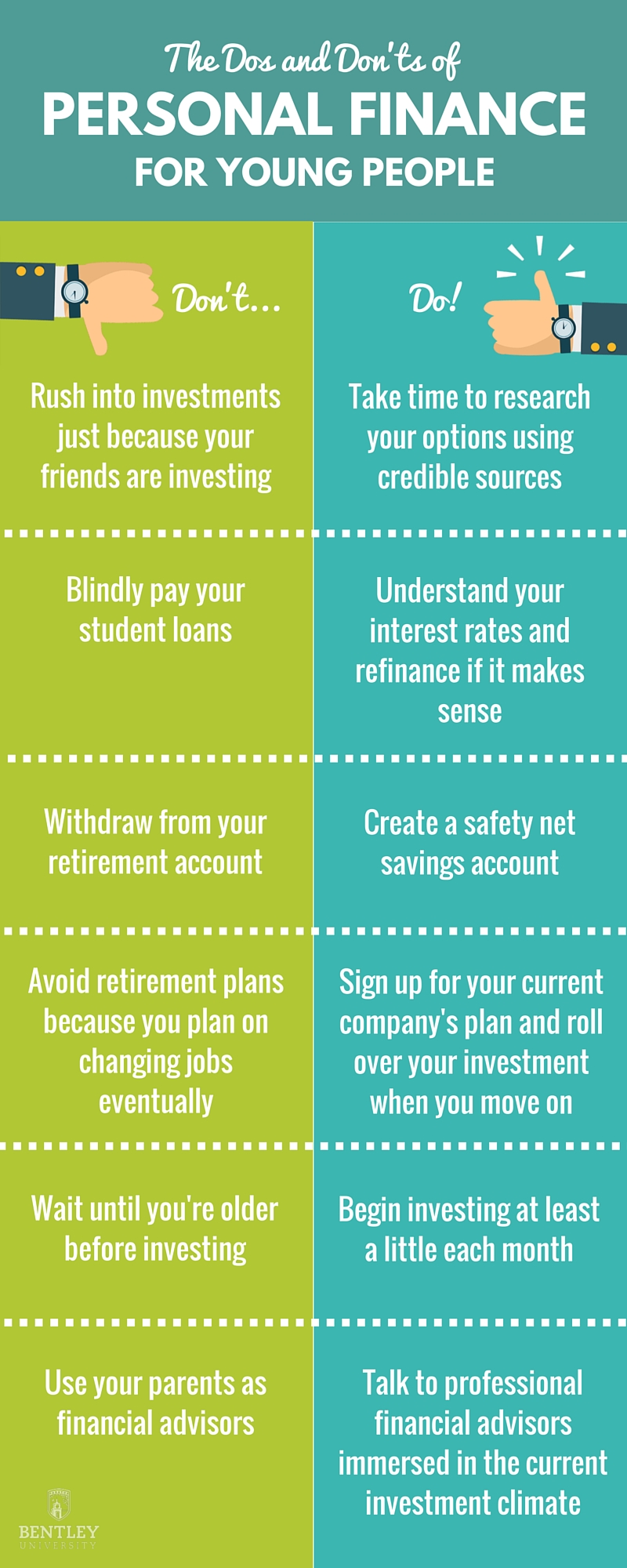

He sees these common mistakes that people early in their career make when it comes to finances:

- Making Decisions Out of Fear vs. Education

Hearing that your friend just set up a Roth IRA could send you into panic mode if you haven’t even started to think about saving for retirement. But don’t rush into things because of fear.

Budget time into your life to learn where to start and research options. Make sure you use credible resources, avoiding jargon and biased advice. Some of Liebman’s favorite apps for this include: Credit Karma, Betterment, Robinhood, YNAB or Mint for budgeting, and LearnLux for education and life planning.

If you find you’re interested in knowing more about finance or exploring it as a career, think about going to graduate school for an MBA or finance degree.

Not Knowing Your Interest Rate

Not Knowing Your Interest Rate

About 70 percent of college graduates have student loans, and one of their biggest mistakes is not knowing the loan’s interest rate, says Liebman. “Depending on the type of loan, your interest rate might be high, so it pays to look into refinancing.”

SoFi is one example of an up-and-coming financial technology player that can often undercut student loan interest rates offered by big banks and the government. (And once you pay off debt, you’ll realize you have extra money to invest.)

- Withdrawing Early

It’s great to pool money into a retirement account, but if you need cash for an emergency (think car repair or hospital bills) and withdraw the funds early, you’ll get charged penalty fees and taxes. Instead, allocate money for a safety net—an account where you can get cash fast without fees. This can be as simple as a bank account or moderate-risk brokerage account.

- Not Taking Free Money from Your Employer

Millennials tend to job hop, so they think it’s a waste of time to invest in a company’s 401k or retirement plan for two years then have the hassle of moving it when they leave.

“Most companies offer competitive retirement plans, and contribute a percentage of your salary into the account, so it’s like you’re getting free money,” says Liebman.

Rollover options include a Roth IRA, Rollover IRA and different financial pools. (Caveat: When you change employers, be sure to roll over the money within the allotted timeframe or you may incur tax penalties.)

Read more about why 20-somethings job hop.

- Not Taking Advantage of Your Youth

Your biggest asset when it comes to investing is time. The longer money is in an investment account, the more time it has to grow and build wealth. “Compound interest is often called the eighth wonder of the world because the money you can make over an extra few years of investing makes a significant difference.”

- Listening to Your Parents

When people have questions about their finances, they often call their parents. The problem is, while parents are a good source of advice, most aren’t familiar with the current market of financial tools and opportunities.

And life is different in 2016 than it was in 1980. Boomers married in their early twenties and will likely retire from the same company they’ve been at for decades, for example. Millennials marry in their late twenties and tend to change jobs.

Learn why why millennials refuse to marry.

How a @bentleyu sophomore is helping #millennials make smart #finance decisions #preparedu

TWEET THIS

What does Liebman hope to accomplish with LearnLux? “We’re trying to help change people’s mindset. Instead of fear, we want personal finance decisions to be made out of education, and we want to be the ones providing that access to education.”